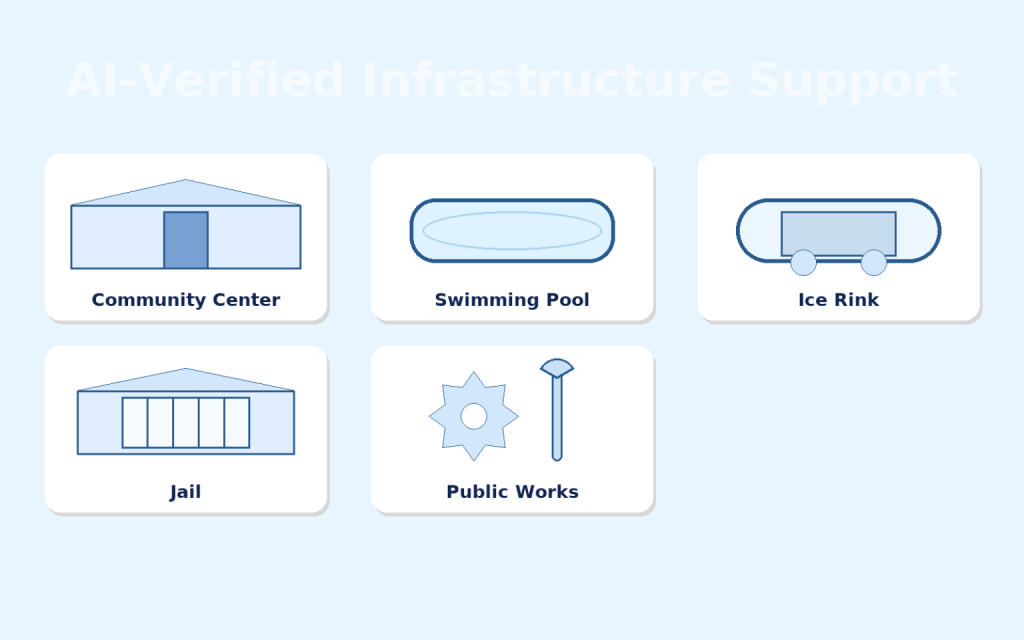

Tokenize your U.S. infrastructure upgrade project, then submit your CIVIC Real World Asset (RWA) in our U.S. listing.

Smart Infrastructure (Smart Infra) = Real World Asset (RWA).

Civic = Public and privately owned infrastructure needing upgrades or repairs.

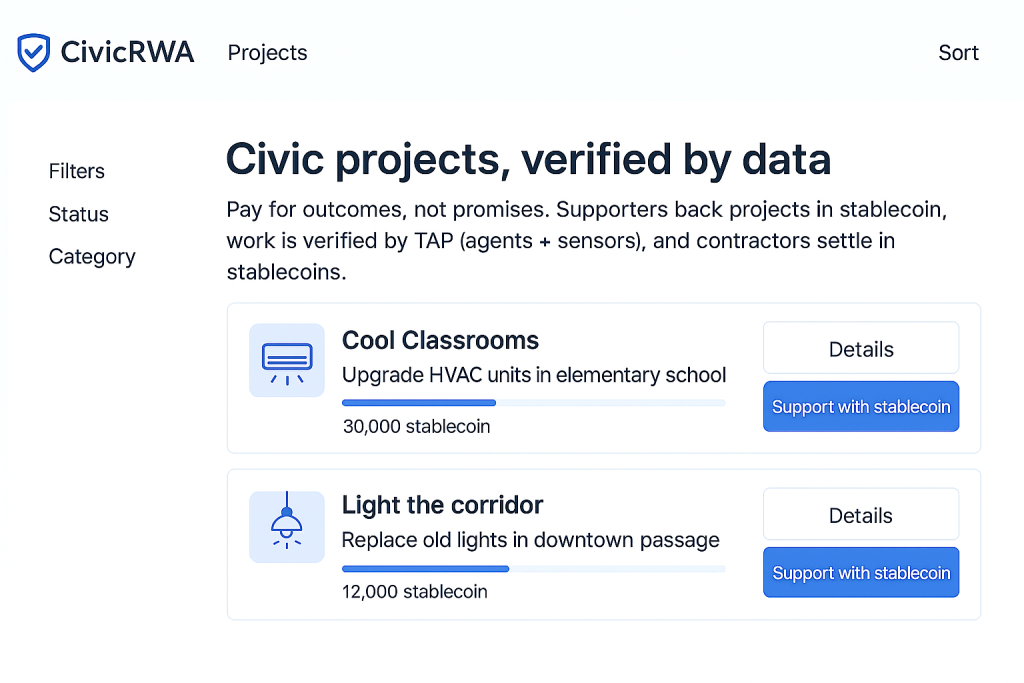

CivicRWA = P2P Tokenized Agentic RWA Tokenizing and Data Access Listings.

“Across the U.S., tens of thousands of public facilities face a US $80 billion+ funding gap (e.g., deferred maintenance and upgrades). Expand to include private infrastructure (commercial real estate, utilities, logistics hubs), and the total deferred maintenance and renewal gap rises into the US $4 – 5 trillion range — representing the addressable market for CivicRWA verification, tokenization and data services.”

Every upgrade or repair generates verifiable agentic data. This data is tokenized and shared peer-to-peer, letting citizens, businesses, and municipalities participate in monitoring ( token gated, having custody of a RWA token grants data access) benefiting from infrastructure improvements.

Locally Escrowed Stablecoin from supporters, verify outcomes with sensors & AI, auto-settle contractors in stablecoin. Lease live infrastructure data access to help fund upkeep of Infra/Civic projects, verified by data.

CivicRWA support charitable support as well as crowdfunded support for RWA projects.

Support for a Decentralized Agentic Donor-Advised Fund – P2P charitable method where AI agents manage, monitor, validate, and report on the impact of donations in real time.

“Donations to public infrastructure projects may be tax-deductible when processed through the city’s approved charitable foundation. CivicRWA issues the required documentation instantly once funds are received.”

Fidelity Charitable + Real-Time AI Oversight + Immutable Proof Receipts.

Agentic DAF (Donor-Advised Fund):

A tax-advantaged giving account, powered by TAP verification.

You donate → receive an immediate tax receipt → funds are only released to contractors when the work is AI-verified and timestamped on CivicRWA.

It’s charitable giving with audit-grade transparency.

Sponsor custody: Stablecoin donations go to the contractor upon completion — that’s when the tax deduction occurs. Donors get a receipt immediately.

Agentic guardrails: TAP logs every action.

- geo constraints (U.S. only),

- category limits (schools, clinics, safety),

- expiry dates,

- conflict-of-interest checks.

Milestone release: When a milestone’s proof receipts pass, the sponsor’s console gets an automated grant recommendation; staff clicks approve →Stablecoin release.

Even if the donor’s payment goes directly to the contractor,

the donation is tax-deductible under IRC §170(c)(1)

if properly receipted and acknowledged by the governmental unit.

Charitable DAFs with real-time AI releases mean donors see impact.

This is 100% allowed.

It happens today with:

- “Adopt-a-Highway”

- “Fund a school playground”

- Police/Fire donations

- Local Parks projects

- School booster contributions

The Stablecoin doesn’t need to go to the city treasury —

it just needs:

- A public purpose,

- A qualified governmental beneficiary,

- A written acknowledgment/receipt from that governmental unit.

CivicRWA’s Agent ‘Dexi’ simply automates all 3.

Under IRS Code §170(c)(1):

Any U.S. state, city, county, school district, or subdivision qualifies as a charitable organization for tax-deductible giving,

as long as the gift is used for “public purposes.”

Transparent local escrow: Stablecoin in user’s Coinbase wallet releases only when KPIs are met and the RWA owner signs off.

Verified outcomes: CTX/DDT provenance ties every decision to agent context and device attestations.

Sustainable upkeep: List live streams in the data listing; revenue auto-splits to supporters, city, and operators.

How it works

- Support — Residents & local orgs support a project in Stablecoin.

- Verify — TAP agents track KPIs (e.g., HVAC comfort/energy, uptime, leaks).

- Settle — When KPIs hold and the city approves, escrow releases; contractors off-ramp to stablecoin.

- Sustain — Metered data leasing shares ongoing revenue with supporters and the community via CivicRWA .

For RWA owners

- Keep procurement: you curate this vendor list, set KPIs, and approve completion.

- Real-time dashboards, policy tokens for access, and clean audit trails (KYA for agents).

- If you already have upgraded your infrastructure , then you can create your RWA and get rewarded for the data your share.

For Contractors

- Clear acceptance criteria; fewer disputes.

- Fast payout on verification; stablecoin settlement via Coinbase.

- Visibility on the approved-vendor list.

For Supporters

- Track progress on public dashboards; share in CivicRWA listing once live.

Example : CivicRWA Fix Calculator

Why RWA Key custody matters

When real‑world infrastructure upgrades and repairs are tokenized, custody is not just about holding tokens—it’s about securing the chain of data, outcomes, and value flows. For CivicRWA, custody must ensure that the data‑backed tokens representing verified infrastructure improvements are properly secured, managed, transferred, and audited.

Key Custody Requirements for CivicRWA

1. Data Provenance & Tokenisation Integrity

Before token issuance, the underlying upgrade/repair data must be anchored and verified (via on‑chain agentic checkpoints). Tokens representing these outcomes must tie directly to immutably‑recorded KPIs (e.g., energy savings, uptime, usage improvements).

Without strong provenance, tokens lose credibility.

2. Regulated Custodian / Asset Servicing Partner

Even if the asset is an infrastructure upgrade rather than traditional securities, institutional credibility demands custody frameworks akin to those used in tokenized RWAs: multi‑signature wallets or MPC key management, insurance cover, audit logs, role‑based access controls.

This gives municipalities, funders, and community members confidence.

3. Lifecycle Management & Token Actions

Tokens should support issuance, redemption, and transfer aligned with the infrastructure lifecycle:

- Mint when verified upgrade is complete

- Burn or lock when value is consumed

- Enable peer‑to‑peer flows (citizens, businesses, funders) under rules

Custody systems must integrate smart‑contract logic that supports those lifecycle events.

4. Compliance‑Ready Transfer Controls

Even though CivicRWA focuses on community utility, jurisdictional rules and investor protections still apply: AML/KYC where required, geo‑jurisdiction blocking, wallet whitelisting. Custody systems must support token compliance controls without limiting participation.

(For example: only verified municipal participants can redeem certain tokens.)

5. Operational Security & Auditability

Infrastructure‑tokenization introduces new risks: device tampering, false data feeds, unauthorized transfers. Custody must incorporate layers of security:

- Hardware Security Modules (HSMs) or MPC keys

- Audit trails of every token and data checkpoint

- Real‑time monitoring for abnormal flows

This ensures the token‑data integrity loop remains airtight.

6. Off‑Ramp Integration & Institutional Bridge

As CivicRWA matures, tokens may interface with broader financial rails (bond markets, infrastructure funds, stablecoins). Custody must support settlement, controlled token off‑ramps, and reporting for institutional investors.

How CivicRWA Applies This Framework

- Tokenised Outcome Model: We tokenize verified infrastructure upgrade data—so custody includes both the tokens and the data‑ledger behind them- like Carfax report.

- Community Access First: While institutional partners may join later, initial custody architecture is designed for citizens and businesses to participate peer‑to‑peer, securely.

- Civic‑Aligned: Ownership of infrastructure remains with the entity; tokenization covers the performance layer. Custody systems are built to reassure public partners that no privatization nor data risk is introduced.Thus increasing the value of the infrastructure and the community quality of life.

- Scalable & Compliant: From small civic pilots to large scale deployments, our custody design anticipates regulated Stablecoin via Coinbase flows, token redemptions, and lifecycle events.

- Tokenizing infrastructure upgrades and data through CivicRWA isn’t just a novel ‑use case—it demands the kind of custody, audit, and lifecycle rigor historically reserved for securities. By treating custody as the foundation of value delivery, CivicRWA ensures that community participants, municipalities, and funders all trust that the tokens they hold reflect real, measured improvement, not speculative promise.